If I Could Pick Stocks for Warren Buffett, I’d Choose This One

The Oracle of Omaha probably won’t ask for stock advice. But he’d probably like this stock.

Does Warren Buffett need help selecting stocks? Of course not. He’s done a really good job of doing it all on his own for decades.

Sure, the legendary investor would likely insist that he’s a “business picker” rather than a stock picker. Buffett would also probably point out that he has farmed out some of the decision-making to his two investment managers, Todd Combs and Ted Weschler, for quite a while.

But let’s suppose that Buffett asked me to give him a hand choosing one stock to buy for Berkshire Hathaway‘s (NYSE: BRK.A) (NYSE: BRK.B) portfolio. If that wild scenario happened today, which stock would I recommend? I think I’d go with The Home Depot (HD -0.04%).

Image source: The Home Depot.

Why Home Depot would make a great Buffett stock

I view Home Depot as a great Buffett stock in part because it once was a Buffett stock. He initiated a position in the home improvement giant 20 years ago but eventually sold all of Berkshire’s stake in the second quarter of 2009.

Buffett might wish he had held onto those shares in retrospect. Over the 14 years since he exited Berkshire’s position in Home Depot, the stock has skyrocketed roughly 1,570%. That’s more than double the gain delivered by Berkshire Hathaway itself. The Home Depot’s total return, including reinvesting dividends, since Buffett bailed on the stock in 2009 is around 2,370%.

The Oracle of Omaha would probably like Home Depot’s solid operating margin of 13.1%. I suspect that he would absolutely love the company’s return on invested capital (ROIC) of around 31.2%.

We don’t have to worry about Buffett not liking Home Depot’s business. It’s certainly one that he understands. Buffett has even recently bought stocks that benefit from some of the same trends as Home Depot — homebuilders D.R. Horton (NYSE: DHI) and both share classes of Lennar (NYSE: LEN) (NYSE: LEN.B).

The median age of U.S. homes has increased quite a bit since Buffett last owned Home Depot. It stood at 41 years in 2023, according to the American Community Survey. Aging homes bode well for demand for home improvement products and supplies over the coming years.

The fly in the ointment

Is Home Depot the perfect Buffett stock? I wouldn’t go that far. There is one fly in the ointment.

Like many stocks these days, Home Depot has a relatively high valuation. Its trailing 12-month price-to-earnings (P/E) ratio and its forward P/E are close to 26. Buffett learned from the father of value investing, Benjamin Graham. Would he balk at paying such a premium for Home Depot? Maybe, but maybe not.

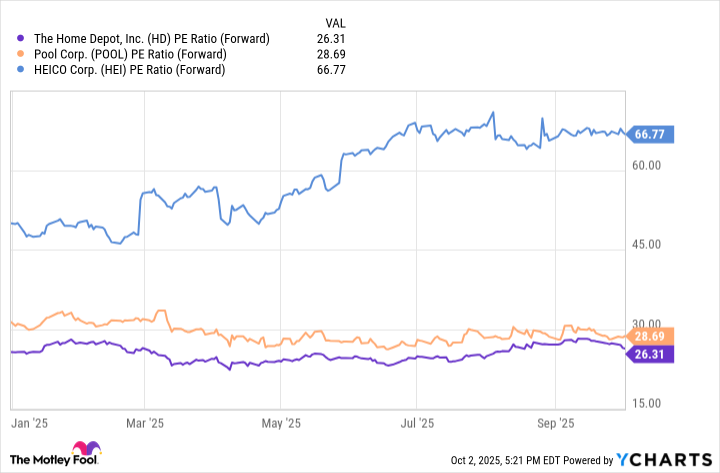

Berkshire bought 12 stocks in Q2. Several of them were bargains that you’d expect Buffett to like. However, two had forward earnings multiples that have been consistently higher than Home Depot’s all year: Heico (NYSE: HEI), which currently trades at a sky-high 66.8 times forward earnings estimates, and Pool Corp. (NASDAQ: POOL), which has a forward P/E of 28.7.

HD PE Ratio (Forward) data by YCharts

Perhaps Heico and Pool are part of the portfolio managed by Combs and Wexler. However, Buffett hasn’t been afraid of paying more for quality in the past when he’s been confident about a company’s long-term earnings growth prospects.

Is Home Depot a good pick for every investor?

I selected Home Depot because it was a stock I thought would fit well with Buffett’s investing style. Is this stock a good pick for every investor? Probably not.

I suspect that a purist value investor (which I don’t think describes Buffett, by the way) would prefer to quickly move past Home Depot for the reasons already discussed. The home improvement retailer’s dividend yield of 2.3% might not be juicy enough for some income investors. And growth-oriented investors can certainly find stocks that are more likely to deliver stronger earnings growth than Home Depot.

And even though Home Depot is the stock I’d pick for Buffett, I don’t personally own it. I like the stock, but I like others more. And, unlike Buffett, I’m not sitting atop a cash stockpile of $344 billion.

Keith Speights has positions in Berkshire Hathaway. The Motley Fool has positions in and recommends Berkshire Hathaway, D.R. Horton, Home Depot, and Lennar. The Motley Fool recommends Heico. The Motley Fool has a disclosure policy.