Futu Holdings Ltd. (NASDAQ:FUTU) Presents a High-Growth Momentum and Technical Breakout Opportunity

Futu Holdings Ltd. (NASDAQ:FUTU) has emerged as an interesting candidate for high growth momentum investors, combining solid fundamental growth with a good technical setup. The stock was identified using a screening strategy that targets companies with a High Growth Momentum Rating above 4, indicating good earnings and sales momentum, alongside a Technical Rating and Setup Rating above 7, which signal both a healthy uptrend and a favorable entry pattern. This approach aims to capture stocks that are not only growing quickly but are also positioned for possible near-term price breakouts, aligning with strategies popularized by CANSLIM and Minervini methodologies.

High Growth Momentum Fundamentals

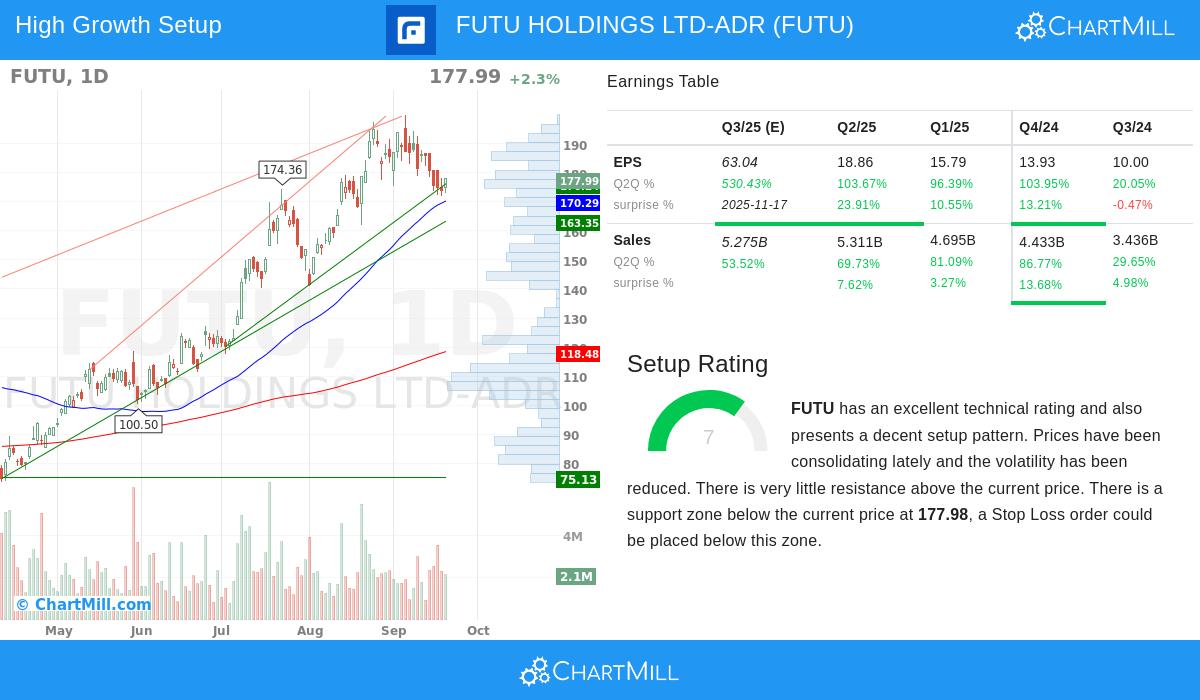

Futu’s fundamental profile reflects the qualities that high growth investors typically seek. The company has demonstrated notable momentum in both earnings and revenue, supported by accelerating growth rates and positive analyst sentiment. Key metrics include:

- EPS Growth (Q2Q): Recent quarter growth of 103.67%, with previous quarters showing 96.39% and 103.95%, indicating maintained upward momentum.

- Revenue Growth (Q2Q): Sales growth of 69.73% in the latest quarter, following prior growth rates of 81.10% and 86.77%, highlighting consistent top-line expansion.

- Profit Margin Expansion: Margins have improved sequentially, from 38.45% three quarters ago to 48.47% in the most recent quarter, reflecting operational efficiency and pricing power.

- Estimate Revisions: Analysts have revised next-year EPS estimates upward by 14.93% over the past three months, signaling increasing confidence in future performance.

These factors contribute to Futu’s High Growth Momentum Rating of 7, placing it with stocks with significant short-term earnings acceleration and fundamental strength. For momentum investors, these elements are critical as they often come before continued price appreciation, especially when combined with positive market trends.

Technical Strength and Setup Quality

From a technical perspective, Futu shows good health with a ChartMill Technical Rating of 9, indicating it is in a solid uptrend and doing better than 96% of stocks in its sector and the broader market over the past year. The long-term trend remains positive, although recent trading has shown some consolidation within a range. Importantly, the stock has a Setup Rating of 7, suggesting it is forming a constructive pattern with lower volatility and clear support levels, which often comes before a possible breakout.

Key technical observations include:

- Support and Resistance: Strong support is identified around $177.98, formed by multiple trendlines and moving averages, providing a logical level for stop-loss orders. Resistance is noted near $194.75, which could serve as a near-term target.

- Consolidation Pattern: The stock has been trading between $172.10 and $199.86 over the past month, with current prices near the lower end of this range, indicating a possible base-building phase.

- Relative Strength: Futu’s relative strength score of 96.58 highlights its outperformance compared to peers, a trait valued by momentum investors.

For a detailed technical analysis, readers can review the full ChartMill Technical Report.

Investment Implications

The combination of high growth momentum and a favorable technical setup makes Futu an interesting watch for investors employing strategies that blend fundamental and technical analysis. The stock’s strong earnings acceleration, margin expansion, and positive revisions align with the criteria used in high-growth screens, while its technical consolidation offers a possible entry point for those anticipating a breakout. However, investors should note that the setup suggests a tight stop-loss, which may require careful risk management given the stock’s average daily volatility.

Explore More Opportunities

For investors interested in discovering similar high-growth momentum stocks with technical breakout patterns, additional candidates can be found using the High Growth Momentum Breakout Setups Screen. This tool helps identify stocks that meet these rigorous criteria, saving time in the research process.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consider their risk tolerance before making any investment decisions.