Why the Schwab U.S. Dividend Equity ETF Could Be a Top Choice for Dividend Investors in 2025

Instead of choosing just one or two stocks, buy a bunch of quality dividend-payers with a single ETF.

For income investors, the only thing better than dividend stocks are dividend exchange-traded funds (ETFs). With a dividend ETF, you get all the benefits of a dividend stock — including a regular payout — but you also have the advantage of diversification.

Face it: Unless you are investing in a stock like Nvidia that’s in the middle of an unprecedented run, it can be challenging to identify the best stocks that can offer long-term growth. And Nvidia’s stingy payout of $0.01 per quarter isn’t worth the time if you are seeking income.

Fortunately, there are quite a few dividend ETFs on the market, but in my eyes, the Schwab U.S. Dividend Equity ETF (SCHD 0.85%) is the best of the bunch for 2025.

About the Schwab U.S. Dividend Equity ETF

This ETF is offered by Charles Schwab Asset Management, one of the leading financial firms on Wall Street. The ETF tracks the Dow Jones U.S. Dividend 100 Index, which includes stocks that have a track record of consistent payouts. Stocks in the fund are also carefully screened for superior fundamentals compared to their peers.

The SCHD ETF is a passively-managed fund, which keeps the expense ratio at a low 0.06%, or $6 in annual fees per $10,000 invested, far below what you’d find in an actively-managed fund. It has $71 billion in total net assets.

Top holdings of the ETF represent dividend-friendly sectors such as healthcare, consumer, industrial, and energy stocks.

|

Top 10 Holdings |

Portfolio Weight |

Dividend Yield |

Sector |

|---|---|---|---|

|

AbbVie |

4.22% |

3.0% |

Healthcare |

|

ConocoPhillips |

4.10% |

3.3% |

Energy |

|

Chevron |

4.09% |

4.3% |

Energy |

|

Home Depot |

4.08% |

2.2% |

Consumer cyclical |

|

Lockheed Martin |

4.08% |

2.7% |

Industrial |

|

Cisco Systems |

4.04% |

2.4% |

Technology |

|

Verizon Communications |

4.01% |

6.4% |

Communication services |

|

Amgen |

3.99% |

3.4% |

Healthcare |

|

Altria Group |

3.97% |

6.5% |

Consumer defensive |

|

Coca-Cola |

3.91% |

3.1% |

Consumer defensive |

Data source: Schwab Asset Management (as of Sept. 25, 2025)

One thing to know about investing in a dividend ETF: While the payout schedule is consistent, the amount that you’ll get may not be. Dividend ETFs collect dividends from the stocks of companies they hold and then pass them on to ETF shareholders on a regular basis. Because the companies have different schedules for their dividend payouts, the ETF’s distributions will vary each quarter.

Image source: Getty Images.

Why the SCHD ETF works for dividend investors in 2025

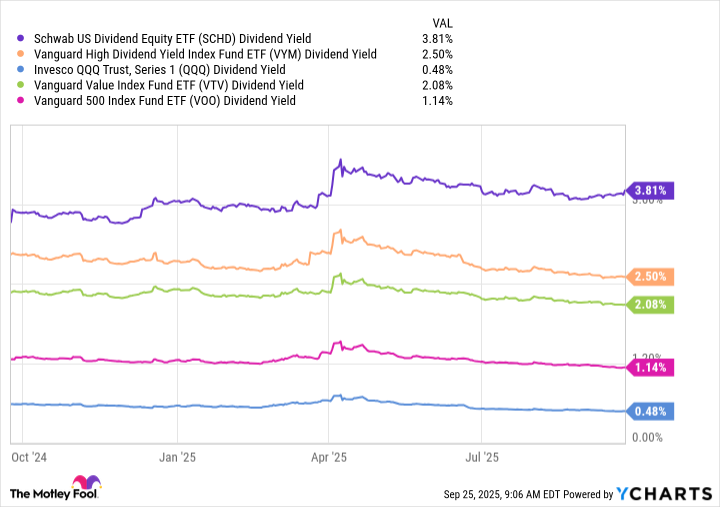

The Schwab U.S. Dividend Equity ETF is one of the biggest and best-known dividend ETFs in the market. What you may not realize is that it also provides one of the highest dividend yields you can find. Compared to other funds in its class, the SCHD ETF stands out as you can see below.

Data by YCharts.

As shown above, the SCHD gives income investors both yield and quality. The Vanguard High Dividend Yield Index Fund ETF provides a yield more than a full percentage point lower. And compared to broader index funds, the Vanguard Value Index Fund ETF offers about a 2.1% yield, while the tech-heavy Invesco QQQ Trust yields just 0.5%. For investors who are seeking income, the appeal of the Schwab ETF is clear.

The bottom line

If there’s any concern regarding this ETF, it’s a limited exposure to the technology sector. Tech has been the best-performing sector on Wall Street for years, and while the fund holds some decent tech names, many of the best-performing tech stocks don’t offer a dividend that allows them to be included in its holdings.

Investors who prioritize dividend stocks would still do well to choose the SCHD ETF as part of their balanced portfolio. But if you also want to make sure you’re tapping into major trends like artificial intelligence, it would be wise to also put some money into a tech ETF or a basket of top-performing tech stocks.

Patrick Sanders has positions in Invesco QQQ Trust and Nvidia. The Motley Fool has positions in and recommends AbbVie, Amgen, Chevron, Cisco Systems, Home Depot, Nvidia, Vanguard Index Funds-Vanguard Value ETF, Vanguard S&P 500 ETF, and Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF. The Motley Fool recommends Lockheed Martin and Verizon Communications. The Motley Fool has a disclosure policy.