STERLING INFRASTRUCTURE INC (NASDAQ:STRL) Shows Strong Momentum with High Growth and Technical Ratings

Investors looking for high-growth momentum opportunities often search for companies showing strong earnings acceleration, positive estimate revisions, and solid technical patterns. This method mixes fundamental growth measurements with technical study to find stocks that may be set for a possible extension of their upward path. By filtering for securities with high growth momentum ratings together with good technical and setup scores, investors can identify companies going through both fundamental momentum and positive chart patterns.

Fundamental Growth Analysis

STERLING INFRASTRUCTURE INC (NASDAQ:STRL) shows positive growth traits that fit with momentum investing ideas. The company’s earnings performance indicates notable acceleration over several periods, a main part of the High Growth Momentum Rating method that looks at both past performance and future indicators.

The company’s growth measurements show a number of positive points:

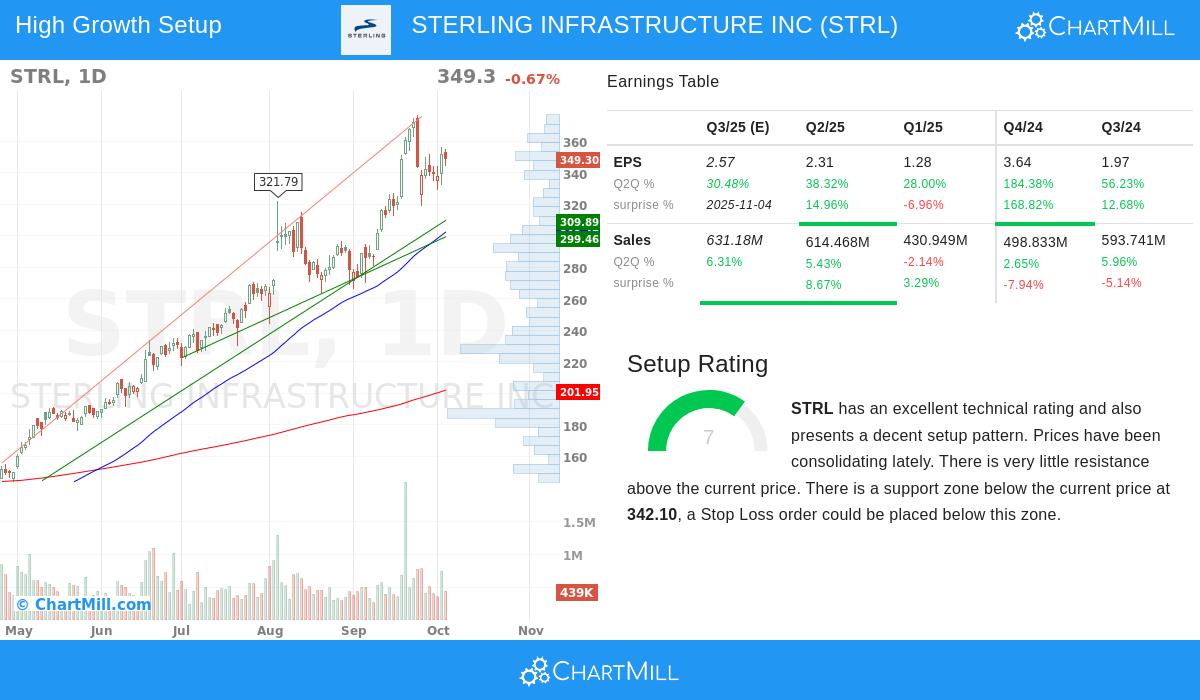

- EPS growth of 76.5% over the last twelve months

- Quarterly EPS growth rates between 28% and 184% in recent quarters

- Free cash flow growth of 51.7% compared to the previous year

- Three straight EPS estimate beats with an average surprise of 47.4%

Profit margin growth gives more proof of operational betterment, rising from 4.4% three years ago to 12.2% in the latest fiscal year. Analyst opinion has become more positive, with next-year EPS estimates moved upward by 10.5% over the last three months. These fundamental gains are important for momentum investors, as speeding up earnings and growing margins frequently come before continued price gains.

Technical Strength Assessment

The technical picture of STERLING INFRASTRUCTURE INC shows very good strength, receiving a complete Technical Rating of 10. This score shows the stock’s place in the highest group of all rated securities from a technical viewpoint. Several parts add to this excellent rating, including the stock’s relative strength and trend features.

Important technical notes contain:

- Both short-term and long-term trends are positive

- The stock does better than 95% of all stocks on a yearly performance basis

- Inside the Construction & Engineering industry, STRL does better than 96% of similar companies

- Current trading close to 52-week highs shows maintained momentum

- All main moving averages (20, 50, 100, and 200-day) are going up

The stock’s technical condition is further shown by its steady performance over several periods, with increases of 22.1% over one month, 47.6% over three months, and 232.8% over six months. This multi-period strength is typical of stocks in confirmed uptrends, which matches with the momentum investing method of following strong trends.

Setup Quality and Trading Considerations

With a Setup Rating of 7, STERLING INFRASTRUCTURE INC shows a consolidation pattern that could provide a possible entry chance. The setup study shows prices have been trading in a set area between $280.81 and $376.75 over the last month, with current placement near the top edge of this area.

The technical form gives clear reference points for risk control:

- Support is found in the $332.99 to $342.10 area, made by several trendlines and moving averages

- More support levels are found at $309.89 and $295.80 to $302.47

- Little resistance above current prices indicates possibility for continued upward movement

For investors thinking about position entry, the detailed technical analysis indicates a possible setup with entry above $376.76 and stop loss below $332.98, representing a measured risk of about 11.6%. This kind of defined risk-reward situation is necessary for momentum investors trying to benefit from continuation patterns while controlling downside exposure.

Conclusion

STERLING INFRASTRUCTURE INC stands as a positive example in high-growth momentum investing, mixing strong fundamental growth traits with very good technical condition and a defined setup pattern. The company’s earnings acceleration, margin growth, and positive estimate revisions give the fundamental base for continued momentum, while the technical view supports the likelihood of trend continuation.

The same-time existence of high scores across growth momentum, technical strength, and setup quality is somewhat rare, making STRL worth attention for investors using this method. As with any momentum plan, correct position sizing and risk control stay important parts of use.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with a qualified financial advisor before making investment decisions. Past performance is not indicative of future results.