Stock-Split Watch: Is Quantum Computing Next?

The share price is up big, but Quantum Computing is still a highly speculative investment.

Interest in quantum computing stocks has ramped up in 2024 and 2025, and many of the industry’s big players have seen their share prices soar. One of the best performers is Quantum Computing (QUBT 23.00%), which is sitting on one-year gains of over 2,800% as of Oct 1.

That rapid growth has taken Quantum Computing, also known as QCi, from a micro-cap stock worth about $60 million to a mid cap worth nearly $3 billion. Could management be considering a stock split after this company’s recent success? Quantum computing stocks are unpredictable, but there’s more than enough information to venture a guess — and decide if QCi is a worthwhile investment.

Image source: Getty Images.

How stock splits work

First, a short primer on what a stock split entails. Stock splits are when a company increases or decreases its outstanding shares, which also causes a change in its share price. It’s important to note that the underlying value of the company doesn’t change from a split.

There are two ways a company can split its stock. It can carry out a forward split, where it divides its shares and reduces its share price. Let’s say a company trades at $500 per share and conducts a 5-for-1 forward split. For every share you own pre-split, you’d receive five new shares priced at $100. The value of your holdings stays the same, but you have more shares at a lower share price.

Companies can also do the opposite by conducting a reverse split, where the number of shares decreases and the share price increases. For example, A company is trading at $2 and conducts a 1-for-10 reverse split. For every 10 shares you own pre-split, you’d receive one share priced at $20.

Forward splits are usually positive developments. A successful company splits its stock so the share price doesn’t get too expensive and drive away potential investors. Reverse splits are often (though not always) bad news. Companies typically use reverse splits to boost their share prices and avoid getting delisted by a stock exchange.

Is a stock split coming for Quantum Computing?

QCi has executed stock splits twice before, with each being a reverse split to increase its share price. The first was a 1-for-100 reverse split in August 2007, and the second was a 1-for-200 reverse split in July 2018. To date, QCi hasn’t carried out a forward stock split, and at its current share price of around $20, that’s unlikely to change soon.

However, QCi did issue and sell more shares last month through a $500 million private placement. A private placement is different than a stock split, since it increases the number of shares in circulation. In this case, QCI sold 26.9 million shares to large shareholders and an institutional investor.

Private placements have their pros and cons. They lead to share dilution, since issuing new shares means current shareholder positions are worth less.

On a positive note, they inject more cash into companies to fund operations. And in QCi’s case, its private placement was oversubscribed, meaning demand exceeded the number of shares issued.

The future of Quantum Computing stock

QCi could decide to split its stock in the future if the share price jumps well into the triple digits, or if it plummets and is at risk of being delisted by the Nasdaq. Neither scenario is completely implausible, considering how volatile the stock is. It was trading below $1 for much of last year, before interest in quantum computing stocks sent its price soaring.

But I think the idea of QCi needing to carry out a forward split is highly optimistic. The main selling point for this company is its photonics technology, which allows its quantum systems to function at room temperature. While this is valuable, rival IonQ also has systems that can operate at room temperature through its trapped-ion technology.

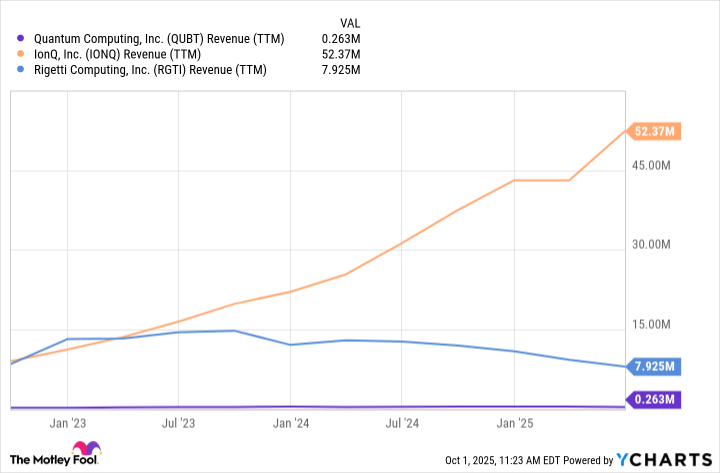

The most glaring problem for QCi is that it’s barely making any money, even compared to companies in the same industry. Here’s how its trailing 12 months of revenue compares to peers IonQ and Rigetti Computing.

QUBT Revenue (TTM) data by YCharts; TTM = trailing 12 months.

That’s QCi at the bottom, with just $263,000 in revenue. Over the first six months of 2025, it made less than half as much ($100,000) as it did in the first half of 2024 ($210,000).

Quantum computing is still an emerging sector, and the pure-play companies are operating at a loss. Even so, QCi’s minuscule revenue is concerning. Because this company is such a high risk, it’s best to be cautious about how much you invest in it.