SEBI Analyst Recommends Buy On These Two High-Flying Chemical Stocks

Both stocks have seen gains of over 40% so far this year, supported by bullish retail sentiment.

Two chemical stocks – India Glycols and Pondy Oxides & Chemicals – have seen a stellar run in the last six months, with India Glycols rising over 50% and Pondy Oxides’ seeing over 100% rally. Analyst believes that there is more room for rally ahead.

SEBI-registered analyst Palak Jain is bullish on these two stocks, driven by strong technicals and fundamental support. Let’s take a look at her recommendations:

India Glycols

Jain noted a range breakout above resistance after a multi-month consolidation in India Glycols. A strong volume buildup and bullish RSI momentum backed this. The stock has surged 55% over the last six months, and its technical setup and fundamental performance support further upside potential.

She added that this green chemical and biofuels producer has shown robust margins and an improvement in debtor days, indicating strong growth. Its Q1 FY26 revenue rose 7.4% to ₹1,041 crore, while profits surged 21% to ₹73.25 crore.

Jain recommended buying India Glycols above ₹927, with a stop loss at ₹833 for target prices of ₹954, ₹982 and ₹1,036.

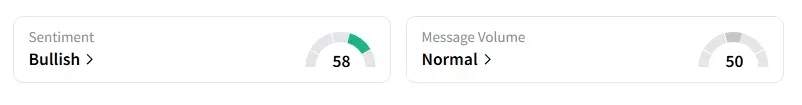

Data on Stocktwits shows that retail sentiment turned ‘bullish’ a day ago from ‘neutral’ last week.

India Glycols shares have risen 42% year-to-date (YTD).

Pondy Oxides & Chemicals

She noted a cup and handle breakout, supported by strong volumes, with price holding above multi-month resistance. Other technical indicators, such as the DMI and RSI, were in bullish alignment for upward continuation.

The stock has seen a stellar 120% surge in the past six months.

On the fundamentals, Jain highlighted that the company was a market leader in recycled lead/zinc with a robust export share. Pondy Oxides has zero long-term debt and consistently posted operating profit growth. Q1 FY26 revenue increased by 36% to ₹596 crore, with net profit surging 90% to ₹28 crore.

She expected improved cash flows and sector demand to drive further fundamental sustainability. Jain recommended buying above ₹1,266, with stop loss at ₹1,139 and target prices of ₹1,304, ₹1,343, and ₹1,417.

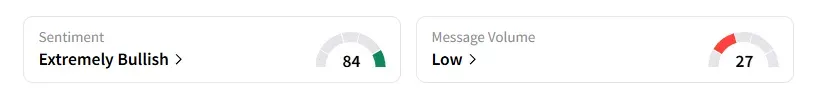

Data on Stocktwits shows that retail sentiment turned ‘extremely bullish’ a day ago from ‘neutral’ last week.

Pondy Oxides’ shares have risen 42% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.