EXELIXIS INC (NASDAQ:EXEL) Stands Out as an Affordable Growth Stock

Investors looking for growth chances at fair prices often use screening methods that consider several basic factors. The “Affordable Growth” method focuses on companies with solid growth paths alongside good financial condition and earnings, all while avoiding high price tags. This system helps find businesses that mix expansion possibility with financial steadiness, possibly providing good returns for the risk taken. By setting minimum scores for growth, price, condition, and earnings aspects, this method selects for companies showing balanced basic strength instead of following speculative trends.

Growth Path

EXELIXIS INC (NASDAQ:EXEL) shows notable growth traits that build its case as an affordable growth pick. The company’s growth score of 8/10 points to good past results and positive future outlook. Recent financial reports indicate good movement in important measures, with large gains in both sales and profits. The company’s growth trend points to lasting enlargement instead of short-term jumps, backed by steady results over different periods.

Important growth measures are:

- Earnings Per Share growth of 67.74% over the past year

- Sales increase of 10.73% in the last year

- Five-year yearly EPS growth rate of 12.65%

- Expected EPS growth of 22.20% each year from future estimates

This solid growth picture is especially notable considering the company’s place in the competitive biotechnology field. The quickening EPS growth rate, paired with continued sales growth, indicates the company is effectively growing its activities while keeping operational effectiveness.

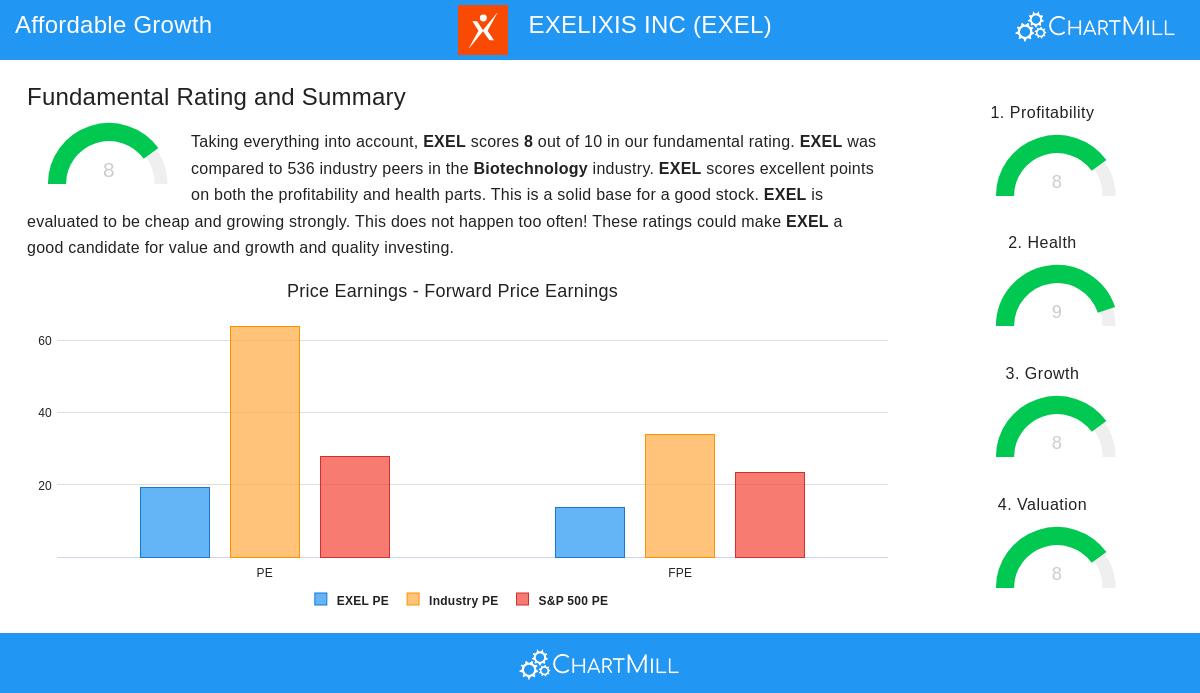

Price Evaluation

The company’s price rating of 8/10 shows appealing costs compared to both industry similar companies and wider market measures. While some standard measures may indicate average price levels, comparison study shows notable lower prices when thinking about the company’s growth chances and industry standing. The price story gets especially interesting when looking at future-facing measures and relative comparisons.

Price points of interest are:

- Price/Earnings ratio of 19.27, less expensive than 94.78% of biotechnology industry similar companies

- Price/Forward Earnings ratio of 13.74, much lower than industry average of 33.97

- Enterprise Value/EBITDA ratio ranking less expensive than 95.52% of industry rivals

- Price/Free Cash Flow ratio more appealing than 96.64% of field similar companies

The company’s PEG ratio, which changes the P/E multiple for expected growth, points to especially interesting value. This mix of fair total price and notable relative discount to industry standards makes an appealing situation for growth-focused investors looking for sensible starting points.

Financial Condition and Earnings

Beyond growth and price, EXELIXIS shows excellent financial condition and good earnings, scoring 9/10 and 8/10 in these groups. The company’s balance sheet firmness gives important steadiness for growth-focused investors, lowering basic risk while supporting continued enlargement. The condition rating shows outstanding solvency and cash positions that set the company apart in its field.

Financial condition strong points are:

- No existing debt, removing interest costs and failure risk

- Current ratio of 3.51 showing good short-term cash availability

- Altman-Z score of 12.38 indicating very low failure risk

- Steady share count decrease through repurchases

Earnings measures show operational quality:

- Return on Equity of 29.62%, doing better than 97.39% of industry similar companies

- Profit margin of 27.01% placed in the top group of the biotechnology field

- Operating margin of 33.71% higher than 97.76% of rivals

- Gross margin of 96.59% reflecting good price control and cost management

Investment Points

The mix of good growth, fair price, and excellent financial basics makes EXELIXIS an interesting option for investors using affordable growth methods. The company’s position in the oncology-centered biotechnology field gives contact to population trends and new idea-driven growth, while its financial carefulness gives safety during market changes. The basic picture suggests a company that has effectively moved from development phase to business operation while keeping financial wisdom.

For investors looking for similar chances, other affordable growth options can be found using our specific stock screener. This tool allows changes to growth, price, condition, and earnings settings to find companies fitting particular investment needs. A more detailed basic study of EXELIXIS is in the full basic report.

Disclaimer: This study is based on basic information and screening systems for educational reasons only. It does not form investment guidance, suggestion, or support of any security. Investors should do their own study and talk with financial experts before making investment choices. Past results do not ensure future outcomes, and investment in stocks carries risk of loss.