PTC THERAPEUTICS INC (NASDAQ:PTCT) Combines Strong Growth with Bullish Technical Setup

A combined method for stock study that uses both fundamental and technical views can give investors a wider picture of possible chances. This process centers on finding companies with good basic business expansion, shown by increasing sales and profits, while also finding good buying moments using technical chart formations. By looking for stocks displaying solid expansion measures next to encouraging technical arrangements, investors try to find companies set for both lasting value increase and short-term price movement.

PTC THERAPEUTICS INC (NASDAQ:PTCT) works as a biopharmaceutical firm focused on creating and selling treatments for uncommon diseases. The company’s collection contains treatments for illnesses like Duchenne muscular dystrophy and aromatic L-amino acid decarboxylase deficiency, aiming at specific markets with large unmet medical requirements.

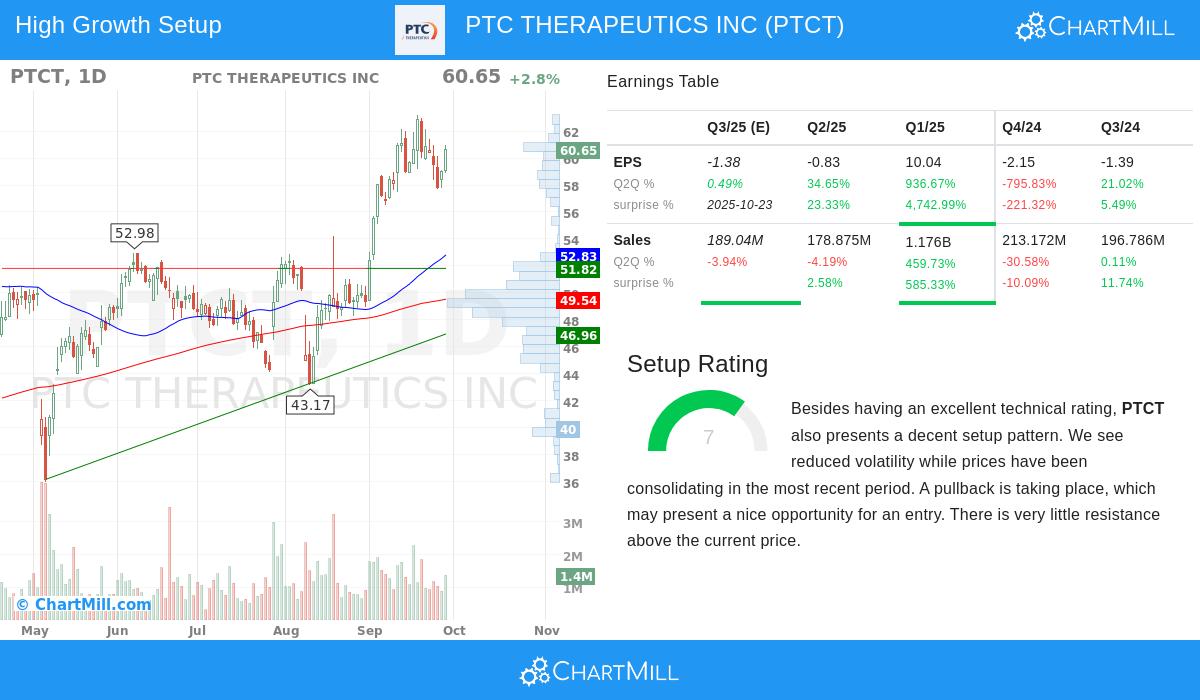

Fundamental Expansion Profile

The company’s fundamental view shows several features common of good expansion candidates. According to the fundamental analysis report, PTC Therapeutics displays:

- Earnings Per Share increase of 226.85% over the last year

- Sales growth of 96.00% in the latest reporting term

- Steady yearly sales increase averaging 21.32% over several years

- Expected EPS increase of 18.99% each year going forward

These expansion measures are much higher than industry norms and match the central idea of expansion investing, finding companies growing quicker than their competitors. The outstanding sales speed especially is notable as it implies the company is effectively selling its rare disease treatments and gaining market position.

Valuation Factors

Even with its notable expansion path, the company shows acceptable valuation measures:

- P/E ratio of 10.70, much under the industry average of 63.78

- Enterprise Value to EBITDA ratio lower than 98% of biotechnology companies

- Price/Free Cash Flow ratio more appealing than 99% of industry rivals

This valuation view makes a notable situation where higher-than-average expansion is available at lower-than-average multiples, a mix often wanted by expansion investors who wish to prevent paying too much for growth possibility.

Technical Arrangement Study

The technical analysis shows an encouraging chart formation that supports the good fundamental account:

- Both near-term and long-term directions are positive

- Stock results over the past year are better than 91% of all market instruments

- Present price movement shows stabilization inside a set band followed by breakout possibility

- Several base levels are present between $43.84 and $57.83, giving technical safety buffers

The technical arrangement suggests the stock is gaining force after notable increases, with lessened recent instability hinting at possibility for the next upward move. This formation fits well with the screening process that looks for technically sound entry points in fundamentally good expansion companies.

Investment Logic

The mix of PTC Therapeutics’ fundamental expansion features and technical placement makes a strong case for review. The company works in the biotechnology field, concentrating on rare disorders, a specific market with built-in expansion possibility because of few treatment choices and often faster approval paths. The large sales speed shows successful product selling, while the acceptable valuation multiples give some protection not usual in high-expansion biotech names.

The technical view supports the fundamental account, showing a stock that has kept its upward path while recently stabilizing gains. This action often comes before more progress as the stock builds force for its next step. The existence of several base levels gives set risk measures for trade management.

More Study Possibilities

Investors curious about similar chances can review other candidates using the Strong Growth Stocks with Good Technical Setup Ratings screen, which methodically finds companies displaying this effective mix of fundamental expansion and technical force.

Disclaimer: This study is for information purposes only and does not form investment guidance, suggestion, or support of any security. Investors should do their own study and talk with financial consultants before making investment choices. Past results do not assure future outcomes, and investing in securities includes risk with possible loss of original investment.